Stay updated on news, articles and information for the rail industry

September 2014

Rail News: Short Lines & Regionals

Rapid City, Pierre & Eastern Railroad aims to become engrained in South Dakota's agricultural products network

— by Jeff Stagl, Managing Editor

An early August drive along interstates 29 or 90 in South Dakota reveals a landscape filled with growing crops of corn, soybeans and wheat. Agriculture is the leading industry in the state, which is home to 31,800 farms stretching 43.7 million acres.

Agricultural products have a $19 billion impact on South Dakota's economy. Each year, more than 4 million acres of corn — the state's No. 1 grain product by volume — are planted and more than 400 million bushels are harvested.

Ag products are equally vital to the Rapid City, Pierre & Eastern Railroad Inc. (RCP&E), which operates 670 miles of track that predominantly traverse South Dakota. The vast majority of the regional's carloads are generated by shipments of grain, primarily corn, soybeans and winter wheat.

In July, RCP&E logged 5,372 carloads, of which 3,280 — or 61 percent — were ag products. The railroad also moved 1,254 carloads of minerals and stone, and 647 carloads of chemicals and plastics, including No. 2 traffic generator bentonite clay, which is used in the hydraulic fracturing process.

For now, generating more grain traffic isn't the main goal for RCP&E, given the health of agriculture in South Dakota and other farming states. The U.S. Department of Agriculture last month projected 2014 corn production would reach a record 14 billion bushels, with yields projected at a highest-ever 167 bushels per acre compared with 157 bushels per acre in 2013. Plus, soybean production is forecasted to climb 16 percent year over year to a record 3.82 billion bushels in 2014.

"First we had a record harvest last year, then a backlog, and now what looks like another record harvest this year. We're not looking for more business," says RCP&E General Manager Todd Bjornstad.

So what is the railroad's top priority? Getting up to speed and up to the task of moving lots of grain, says RCP&E President Brad Ovitt. It will be a formidable challenge to meet the objective because the railroad is less than four months old.

New railroad is launched

RCP&E was "born" on June 1, when operations began after its owner Genesee & Wyoming Inc. (GWI) acquired the former west-end trackage of the Dakota, Minnesota & Eastern Railroad (DM&E) from Canadian Pacific at May's end. CP had acquired the DM&E and its subsidiaries in 2008.

RCP&E operates lines between Tracy, Minn., and Rapid City, S.D.; Rapid City and Colony, Wyo.; Rapid City and Dakota Junction Neb.; and Dakota Junction and Crawford, Neb. The regional also serves several branch lines, and interchanges with CP, BNSF Railway Co., Union Pacific Railroad and the Nebraska Northwestern Railroad.

Lines that once were controlled by a regional for more than two decades, then were part of a Class I network for six years, now are operated by a regional again. RCP&E has been trying to put more resources in place and bolster track to provide the customer-focused service that regionals and short lines are known for, says Ovitt, a fifth-generation railroader who's worked in the short-line industry for more than 27 years, including stints at RailAmerica Inc. as the Midwest Region's regional vice president and VP of transportation.

RCP&E managers also have reached out to state officials, community leaders and shippers to familiarize them with new regional, he says. Reflecting the definition of the word "regional" — something that relates to a large geographic region — the railroad is trying to become engrained in South Dakota and the state's ag products network.

"We first sent out letters to introduce ourselves, and then we met with every customer," says Ovitt, adding that the RCP&E serves more than 50 customers. "We visited with politicians and community leaders, and we let them quiz us."

The primary message the railroad is sending: RCP&E is locally managed and operated, so decisions will be made closer to, and in the best interests of, the customer, he says.

In addition, the railroad is striving to inform numerous shippers and leaders in all four states within its network that RCP&E not only wants to retain but eventually attract new business, stressing that its connection to three Class Is can help customers reach new markets.

At the same time, the regional is trying to win back small customers that diverted to truck while CP owned the lines because they were dissatisfied with the Class I's service performance.

"We need to provide exceptional service," says Ovitt.

Top-notch service will help increase traffic flow on the railroad — annual carloads are projected to reach 52,000 in the first year — as well as boost customers' satisfaction with RCP&E's performance, adds Bjornstad.

More locomotives and rail cars

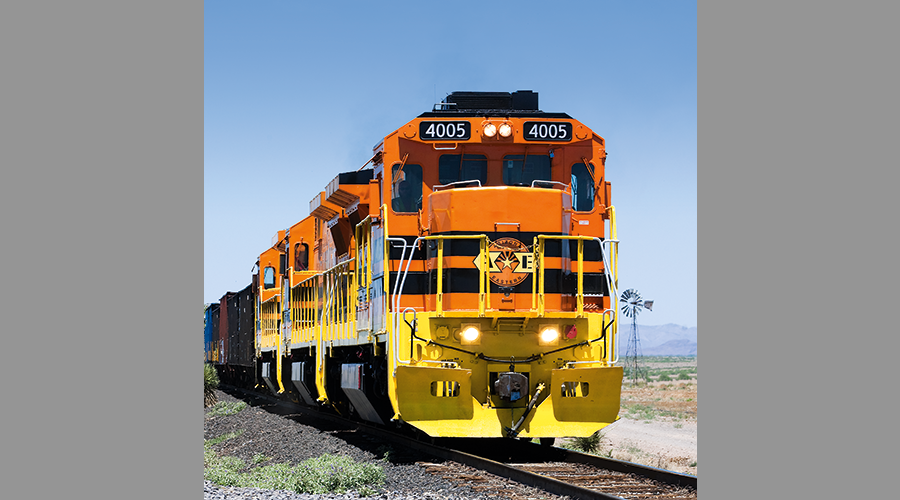

As a step toward becoming an exceptional service provider, RCP&E recently added motive power. The railroad now employs 50 locomotives compared with the 30 CP used on the lines. The regional is in the midst of repainting its locomotives with GWI's orange color scheme and RCP&E's logo, which includes the image of a pheasant that was chosen by employees, says Ovitt. Pheasant hunting is popular in South Dakota and the logo provides a local attachment, he adds.

Since tight car supplies have been an issue for grain shippers for much of 2014, RCP&E also has leased 3,000 covered hoppers. As of early August, the railroad had received 2,000 of them, says Ovitt.

"Car supply has been slower than we would have liked," he says. "We've got to move the harvest out now."

In another grain-service improvement move, the RCP&E and CP last month committed to providing three additional grain trains per week, South Dakota Gov. Dennis Daugaard announced on Aug. 15. Rail service issues arose in June and July due to some complications in train hand-offs from CP to RCP&E, said South Dakota Agriculture Secretary Lucas Lentsch in a press release.

"It was unfortunate that these service issues [happened] when we were getting ready to take in the 2014 harvest," said Lentsch. "I am pleased to see train volumes increasing now, though, and this addition of three more grain trains a week should give producers and shippers some relief."

Surface Transportation Board order

In addition, the Surface Transportation Board (STB) last month began requiring CP — which has struggled to meet grain-car orders and provide sufficient locomotives to RCP&E — to report the number of locomotives moving inbound and outbound from RCP&E's system onto CP's system, U.S. Sen. John Thune (R-S.D.) announced on Aug. 18.

The STB also now requires CP to outline a plan to ensure RCP&E maintains locomotive resources to support its outbound movements and work through backlogged grain shipments, Thune said in a press release. The senator had sent a letter to the STB on July 24 requesting the inclusion of additional reporting requirements in weekly grain-order reports that CP and BNSF must submit to the STB.

"I know these additional requirements will assist shippers as the anticipated record harvest begins," said Thune.

To provide grain shippers another valuable assist, RCP&E is attempting to turn equipment faster, says Ovitt. To that end, the regional plans to boost capacity, primarily by building or extending sidings — including a new 8,000-foot siding in Huron, S.D., designed to better accommodate unit grain trains — and improving yards. The regional operates large yards in Huron and Rapid City, S.D., and smaller yards in Aurora and Belle Fourche, S.D.

The railroad also plans to build a yard in a remote area outside of Huron so workers don't have to deal with two grade crossings while building trains as they do now at the current yard, says Ovitt. The new yard — which could be built as soon as next year and might involve a public-private partnership — also wouldn't have the width restrictions that limit the Huron yard's operations and expansion options, he says.

As part of a $4 million capital spending budget for 2014, RCP&E crews also have installed more than 10,000 ties and completed surfacing work in the Pierre Subdivision east of Blunt, S.D., to increase train speed from 25 mph to 40 mph. The railroad plans to install another 30,000 ties before winter.

The workforce is another key part of the customer-service equation for RCP&E, which employs 185, many of whom are former CP workers. To help move more grain cars, the railroad continues to add crews.

In July, the regional hired 10 train service employees in Huron and four in Rapid City. Four of the new full-time employees will take the place of temporary workers, says Bjornstad.

As it takes on more workers, the railroad will need to continue emphasizing safety, says Ovitt. Safety performance slipped a bit in July, when one worker fell off a rail car and twisted an ankle, two employees were overcome by heat illness while working on a ballast train and the railroad registered three human-factor incidents involving injuries caused by improper switch procedures.

Focusing on rail safety

RCP&E is re-focusing efforts to prevent injuries and incidents, primarily by instilling GWI's safety culture, which calls for quickly identifying and fixing problems, says Ovitt.

For example, soon after GWI assumed operation of the Huron yard, the company replaced wooden stairs at the facility's office that posed a tripping and falling hazard.

The railroad constantly reviews rules and procedures, conducts monthly safety meetings and provides clocks in each of its facilities that count the days, hours and minutes since the last reportable injury.

"Safety is in your face 24/7 — we make it more intense to workers and increase the level of visibility," says Ovitt.

As operational performance improves, RCP&E will continue to seek ways to offer grain shippers more service options.

For example, the regional currently serves five grain customers that are part of BNSF's shuttle-train program. Ovitt & Co. are trying to identify elevators that have enough space for a loop track, which is a program requirement.

"I think there are four or five more that could join the program. If we could add one to two a year, that would be fantastic," says Ovitt.

It also would be great if RCP&E's efforts to improve operations and provide better local service caught shippers' attention. Some grain customers have noticed, and mentioned how communication is better and car supply is improving, says Ovitt.

Meeting soybean shipper's needs

One of them is South Dakota Soybean Processors, which extracts soybean oil and produces soybean meal, oil and hulls at its plant in Volga, S.D. The oil is transported in a crude state to far-reaching points in the United State and Canada, where it's refined and made into salad oil.

About 70 percent of the oil and half the soybean meal produced at the plant is moved by rail, says South Dakota Soybean Processors Traffic Manager Mavis Best. The plant has seven tracks with a 90-car capacity, and manages a fleet of 317 hopper cars and 147 tank cars.

Each day, RCP&E moves about a dozen outbound cars and several inbound cars for the company, which previously was served by CP. Transit times are back to expected levels and communication with RCP&E has been "second to none," says Best.

Although CP's service was beneficial because the Class I could move loads all the way to some destinations without handoffs, larger railroads tend to "put all customers in the same box" and offer a "one-size-fits-all" service, says South Dakota Soybean Processors Chief Executive Officer Tom Kersting. Some of the company's moves are seasonal and don't fit a cookie-cutter service schedule, he adds.

"I would say [RCP&E] is more hands on and flexible," says Kersting. "We like to have flexibility and stability."

Flexibility is key to RCP&E, as well — especially since the regional is so grain-centric. Eventually, the railroad will need to diversify its traffic, says Ovitt. There are no corporate taxes in South Dakota, which might help entice more plants to a state that currently isn't home to much manufacturing, he says. RCP&E managers are working with state officials to determine the potential for manufacturers to locate facilities along the regional's lines.

"In the manufacturing realm, it could be plastic pellets or steel, or even automotive," says Ovitt.

But RCP&E primarily needs to remain focused on its bread and butter. And that could mean expanding grain traffic with UP that's gravitating toward Mankato, Minn., from points in South Dakota instead of the more common moves to Mason City, Iowa.

"We're seeing more of a shift to Mankato because of pricing," Ovitt says.

Business expansion plans notwithstanding, Ovitt knows RCP&E first needs to get operational and safety performance up to snuff before the regional can comfortably take on more traffic. The railroad is making headway despite what's been a tough learning curve as a start-up company.

"We're getting better every day," says Ovitt. "We love how employees are engaged and the level of interest the state has in us."

LRW Honors Amtrak’s Acheson As Railway Woman Of The Year

LRW Honors Amtrak’s Acheson As Railway Woman Of The Year

From Editor-In-Chief Foran: Of Gender Equity And Inclusion

From Editor-In-Chief Foran: Of Gender Equity And Inclusion

Spotlight On Some Of Today’s Rail Safety Products

Spotlight On Some Of Today’s Rail Safety Products

Women of Influence in Rail eBook

Women of Influence in Rail eBook

railPrime

railPrime