Stay updated on news, articles and information for the rail industry

3/12/2024

Rail News: Short Lines & Regionals

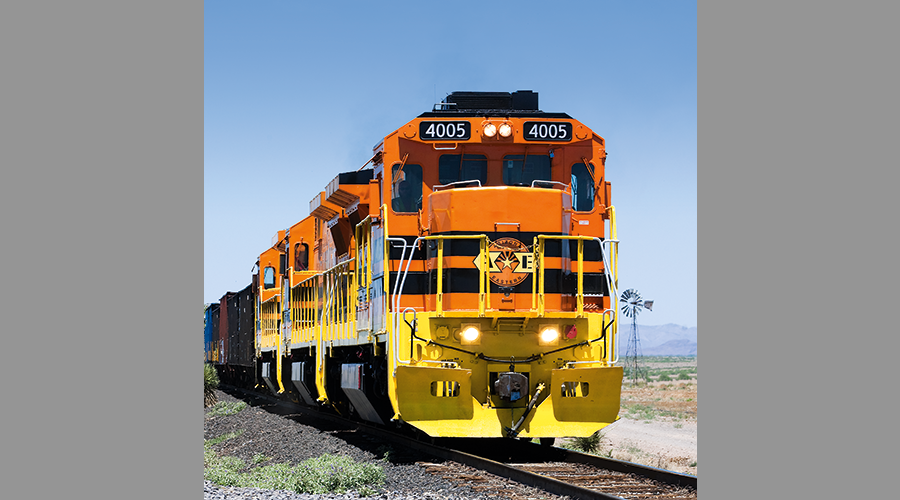

Charging toward 125, and beyond: Genesee & Wyoming maneuvers toward the next transformative marker

By Jeff Stagl, Managing Editor

In 1899, the Genesee and Wyoming Railroad was formed to serve a rock salt mine in Retsof, New York, along 14 miles of track.

More than a century later, the railroad and mine still exist — albeit in much larger forms — and Genesee and Wyoming continues to serve the Retsof operation.

Genesee & Wyoming Inc. (G&W) is the behemoth organization that grew from that humble beginning to become North America’s largest short-line holding company. Its Rochester & Southern Railroad subsidiary serves what now is called American Rock Salt Co. LLC and has evolved over time to become the nation’s largest producing salt mine.

G&W will mark its 125th anniversary on March 24, and although many things have changed at the company during that span — helping to spur enormous growth — one vital thing has stayed the same.

“We were established to serve one customer, and we still serve that customer today. It’s all about customer service,” says Michael Miller, the CEO for G&W North America. “That became the foundation of Genesee and Wyoming and what’s kept us alive for 125 years. You can’t grow if don’t have an environment where the customer matters.”

G&W now owns or leases more than 100 regionals and short lines worldwide — the majority of which are in North America — serves 3,000 customers and employs 7,300. Carloads last year totaled 1.6 million units.

The company’s North American operations are located in 43 states and five Canadian provinces and include more than 13,000 miles of track, while its United Kingdom/Europe operations include the U.K.’s largest rail-centric intermodal logistics franchise and the leading heavy haul freight-rail provider.

G&W subsidiaries and joint ventures provide rail service at more than 30 ports and rail-ferry service between the U.S. Southeast and Mexico, as well as transloading and rail-car switching and repair services.

Publicly traded for many years, G&W has been privately owned by Brookfield Infrastructure Partners LP and GIC since December 2019.

After passing the 125-year mark, what will help G&W maneuver toward building on its legacy and expanding its prospects? For the moment, what’ll help is focusing on creating organic growth and improving the company’s core business, says Miller.

“We’re trying to optimize our business and get better structures in place,” he says. “We are under a five-year plan built around growth, operational excellence and driving a safety culture.”

From the outside in

Those internal objectives differ greatly from G&W’s long period of external endeavors. For about 40 years, the company was very active in the short-line acquisition market.

But before that, the company remained a solo operation as Genesee and Wyoming Railroad for 78 years. Then in 1977, Mortimer Fuller III — the great-grandson of Genesee and Wyoming Railroad founder Edward Fuller — purchased the railroad. Genesee & Wyoming Railroad Inc. was organized as a holding company and the railroad became its first subsidiary.

Mortimer Fuller served as G&W’s president, CEO and chairman from 1977 to 2007, then as chairman from 2007 to 2017, when he retired.

Following the passage of the Staggers Rail Act in 1980 — which deregulated the rail industry and prompted the formation of many small railroads — Fuller led efforts to grow the company by acquiring short lines. Railroads acquired through the mid-90s included the Dansville & Mount Morris in 1985; Rochester & Southern in 1986; Louisiana & Delta in 1987; Buffalo & Pittsburgh in 1988; Allegheny & Eastern in 1992; Willamette & Pacific in 1993; and Portland & Western in 1995.

“The Staggers Act was big. It gave us the opportunity to make acquisitions,” says Miller.

In the late 1990s, Fuller also prompted G&W to expand into the Australian and Canadian rail markets, and guided the company through an initial public offering.

For example, G&W in 1997 purchased the South Australian freight operations of Australian National and rebranded it as Australian Southern Railroad, and in 2000 the Australian Railroad Group — a 50-50 joint venture between G&W and Wesfarmers — won a bid for Westrail in Western Australia. Ownership of Australian Southern Railroad then transitioned to the Australian Railroad Group.

“Those international acquisitions — particularly in Australia — strengthened our financial position and made some larger acquisitions possible later, such as RailAmerica,” says Miller. “It also helped us broaden our North American operations.”

In 2012, G&W acquired RailAmerica Inc., which at the time was North America’s second-largest short-line holding company with 45 regionals and short lines. RailAmerica once owned more than 50 small railroads.

Other G&W acquisitions that occurred between 1999 and 2019 include Rail Management Corp. (which owned 14 short lines); Ohio Central Railroad System (which controlled nine short lines); Emons Railroad Group (which owned four short lines); CAGY Industries (which owned three short lines); Pinsly Railroad Co.’s Arkansas Division (which controlled three short lines); Freightliner Group in the United Kingdom; Providence and Worcester Railroad; CG Railway; Carolina Piedmont Railroad; Arizona Eastern Railway; Heart of Georgia Railroad; Georgia Southwestern Railroad; FreightLink in Australia; and Pentalver Transport Ltd. In Great Britain. The initial Genesee and Wyoming Railroad was absorbed into the Rochester and Southern Railroad’s system in 2003.

Holdings quintupled under Hellmann

The long period of growth-by-acquisition continued during the leadership tenure of Jack Hellmann, who served as CEO from 2007 to September 2023, when he became executive chairman.

After he joined the company in 2000 as chief financial officer, G&W’s holdings grew from 21 short line and regionals in the United States and Canada to more than 100 domestic and international freight-rail operations. In 2017, Hellmann received Progressive Railroading’s Railroad Innovator of the Year Award, which recognizes an individual’s outstanding achievement in the rail industry.

Miller has served as CEO of G&W’s North American operations since September 2023. Tim Shoveller is CEO of the company’s U.K./Europe operations.

Miller’s charge: to keep up the prosperity achieved under Fuller and Hellmann. Miller previously served as G&W’s chief commercial officer for eight years and president of its North American operations for five years. Prior to joining G&W in 2010, Miller was general manager of Norfolk Southern Railway’s Modalgistics Supply Chain Solutions.

But prosperity won’t come from acquisitions anytime soon, Miller says. The main reason: The value of short lines have shot up to undesirable levels. Over time, acquisition market likely will rebound, he believes.

“The market ebbs and flows as values go up and down. We are a judicious buyer of assets. It’s in our DNA,” says Miller. “In the past, we lost out on some acquisitions, but got them the third time they went on the market. We have a great team that knows how to value assets.”

So where will growth come from in the meantime? It starts with superior service, Miller says.

“You have to provide reliable service,” he says.

The voice of the customer

To find out if G&W is delivering on that objective, the company every two years conducts a survey among its 3,000 customers. Performed since 2007, the survey usually garners a 50% to 60% response rate, says Miller.

Customers are asked to rate G&W’s performance on a 1 to 10 scale in five categories: service (operations); customer service; sales and marketing; equipment quality; and inventory and administration management.

“Service is the most important one,” says Miller.

G&W conducted a survey in late 2023, which registered an overall average score of 8.5.

“That was our best score ever,” says Miller. “We need the customer voice to sustain value. This shows how we differentiate ourselves, by putting a face on every customer.”

Most shippers deal with the same customer service representative, who gains an understanding of a customer’s buisness and their biz transportation needs.

“We also empower our people in the field to make decisions in the best interest of the customer,” says Miller.

Yet, G&W needs to first ensure there are enough employees in the field to be making those calls. Retaining workers has been an issue for quite some time — the company’s turnover rate is 15% to 16%, which equates to about 600 to 700 employees a year, Miller says.

“That isn’t sustainable. So, how can we create an environment to keep these people? They will help get us to where we want to go,” he says.

Scheduling is a main reason workers leave. In large cities, some new employees stay on the job only six months to a year because they typically receive a less desirable schedule versus long-time workers due to seniority, says Miller. Plus, the 24/7/365 nature of the job is hard to embrace.

“During training, we are upfront about what the job is like. They see how switching cars in 30 degrees in Rapid City, South Dakota, is not fun,” he says.

Another reason some employees quit? They can’t use their cell phones while operating a train because it’s against federal regulations and poses a safety hazard.

“These are people who grew up with cell phones in their hand. They won’t give them up,” says Miller.

Training, mentoring in mind

G&W aims to address worker retention and better safety adherence through improved training and mentoring programs.

“Safety is a forever plan. We are getting a lot of new people in the industry, and new people create more risk,” says Miller.

During the pandemic, G&W worked to make its training programs more robust. Company leaders decided training needs to be conducted in person, in classrooms, and not remotely or virtually. The company typically conducts a training class at least once a month.

“We made the executive decision to do training face to face. We want to see peoples’ mannerisms and their attention to detail,” says Miller.

In terms of mentoring, an engineer or conductor with 10 years of experience at G&W works for two or three months with a new hire who’s completed classroom training and then decides if that person is qualified for the field.

“Some people are great in a classroom, but then their skills don’t translate in the field,” says Miller.

To emphasize certain important points, Miller addresses every class of new hires, which usually total 20 to 50 people. Many times, he does it virtually.

“I want them to understand how important this industry is to the counrty and what railroading is all about, and how they can contribute,” Miller says.

One way they can pitch in is to help G&W continue to embrace technologies. For example, the company is trying to get more tools in the hands of field managers.

So far, an an electronic dashboard and device used by the managers means they no longer need to count cars or perform as much legwork.

And in terms of infrastructure, G&W-owned geometry cars are used to perform rail-defect testing. The cars run over network twice a year, says Miller.

A technological enterprise

A big portion of G&W’s technological push was completed last year, when the company finished implementing a new enterprise resource planning (ERP) system that replaced a system that was more than 20 years old. An ERP software system helps run an entire organization by supporting automation and processes in finance, human resources, manufacturing, supply chain, services, procurement and other departments.

The ERP was the company’s largest-ever technology investment, says Miller.

“It will drive efficiencies — it touches every facet of our business,” he says. “We are trying to work the bugs out now.”

However, G&W and others in the rail industry generally have been slow to adopt technologies because of regulators, Miller believes.

“We want regulators to be cognizant of that,” he adds.

In the meantime, G&W is pressing on with efforts to be more of a technology adopter. For example, the company is one of the joint-venture members of RailPulse, a coalition of rail-car owners who are working to facilitate and accelerate the adoption of GPS and other telematics technology across the North American rail-car network to significantly increase visibility, efficiency and safety.

“We are the only mode that doesn’t have a real-time location for every shipment, that needs to be a cultural change,” says Miller.

In terms of a car’s location as monitored by railroads, third parties and others, there are “three or four different versions of the truth” as to an exact location, Miller says. That isn’t very helpful to customers.

“We all need to have the same truth,” says Miller. “It isn’t about speed for customers, its about reliability.”

Of automation, algorithms and AI

G&W also is working with Railspire on a project involving locomotive automation. Railspire retrofits locomotives for autonomous driving capabilities to help increase productivity, improve safety and employee retention, and reduce asset damage and costs.

The company aims to bridge the gap between traditional locomotive operations and emerging technologies with human/machine orchestration, artificial intelligence-based train handling and algorithmic control.

In addition, G&W is working with Parallel Systems on a pilot project involving battery-electric rail vehicles for autonomous container movements. Subsidiaries Georgia Central Railway LP and Heart of Georgia Railroad Inc. last year petitioned the Federal Railroad Administration (FRA) to test the zero-emission freight–rail technology on portions of their lines in Georgia.

If the petition is approved, the multi-phased pilot would begin this year and be overseen by the FRA, G&W and Parallel Systems. The demonstration of the technology in the field will involve carefully developed protocols to ensure the pilot is operated in a safe and controlled manner.

G&W officials believe the development and anticipated adoption of the technology has the potential to capture new container business moving to and from the Port of Savannah. It also could reinvigorate traffic on rural lines, revive inland ports in Georgia, remove trucks from the region’s roads and reduce carbon emissions, they stress.

Get it all in alignment

“Potential” remains a key word at G&W in its growth pursuit. And a better way to tap it is through an ecosystem approach that involves the rail industry holistically instead of each rail individually, Miller believes.

There needs to be more collaboration and integrated solutions that leverage each constituent’s strengths and align goals to better meet customers’ needs and demands, he says.

“This is a network businesss, and we as an industry need to operate that way. Ninety-plus percent of of traffic is interchanged with Class Is,” Miller says. “If one part of that network isn’t performing well, we all lose.”

But before G&W can elicit change, it needs to take a step back to decipher how different the company is today versus 125 years ago. For one, G&W is much more diversified, Miller says.

“That railroad 125 years ago suffered if it was a mild winter because their whole business was dependent on rock salt,” he says. “We also are more innovative now, finding ways to be better. We have a more entrepreneurial spirit.”

What might G&W be like well into the future, say in 30 to 35 years? Miller envisions more differences with today’s company.

“I think we will be the cleanest, safest and most reliable mode. We will reach zero emissions by continuing to automate,” he says. “We will keep rail relevant. And I think we can get the customer survey score to a 9.”

Email questions or comments to jeff.stagl@tradepress.com.

Contact Progressive Railroading editorial staff.

LRW Honors Amtrak’s Acheson As Railway Woman Of The Year

LRW Honors Amtrak’s Acheson As Railway Woman Of The Year

From Editor-In-Chief Foran: Of Gender Equity And Inclusion

From Editor-In-Chief Foran: Of Gender Equity And Inclusion

Spotlight On Some Of Today’s Rail Safety Products

Spotlight On Some Of Today’s Rail Safety Products

Women of Influence in Rail eBook

Women of Influence in Rail eBook

railPrime

railPrime